US stocks fell across the board on on Tuesday, as President Donald Trump’s revived tariff threats and potential toughening of China curbs weighed on market optimism and the chances of interest-rate cuts.

Consumer confidence also plummeted in February, notching its biggest monthly decline in more than four years as 12-month inflation expectations jumped and recession fears escalated.

The tech-heavy Nasdaq Composite (^IXIC) fell around 1.6% on the heels of a tech-led selloff on Monday. The benchmark S&P 500 (^GSPC) dropped roughly 0.7%, while the Dow Jones Industrial Average (^DJI) fell about 0.1%.

The biggest move in markets early Tuesday, however, came from the cryptocurrency markets, where the price of bitcoin (BTC-USD) tumbled below $90,000 for the first time since November.

Bitcoin touched a low closer to $86,000 in the early morning hours, its lowest since Nov. 15. The price of ether (ETH-USD), the world’s second-largest cryptocurrency, fell over 10% to below $2,400 early Tuesday. Crypto-related stocks including Coinbase (COIN) and Strategy (MSTR), were also under pressure early Tuesday.

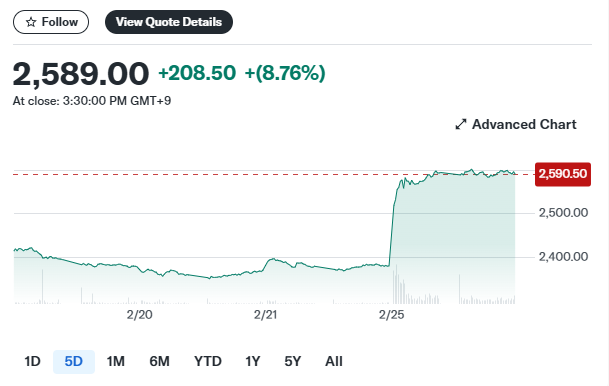

Dow Jones Industrial Average (^DJI)

Trump’s signal that his trade overhaul isn’t over has unsettled markets wondering about the impact on growth prospects. Investors are parsing his brief comment that tariffs on Mexico and Canada will go forward next week.

The benchmark 10-year Treasury yield (^TNX) fell to its lowest level this year, around 4.3%, amid growing belief that tariffs will weaken the US economy. That prompted traders to bump up bets on interest-rate cuts.

At the same time, his administration is said to be pursuing tougher chip curbs on China, after Trump issued a directive to limit investments between the US and the top trading partner. AI chip giant Nvidia’s (NVDA) stock was in focus with its highly anticipated earnings due Wednesday. The company is already facing headwinds from tariffs and export controls.

Elsewhere in earnings, Home Depot’s (HD) fourth quarter revenue beat Wall Street’s low expectations.

LIVE 10 updates